Saving money has never been easy.

If it was, we’d all be living in our dream homes on the water and travelling first class to Rome each year.

When I started working at Mamamia, I was filled with dreams of saving hundreds each month and putting down my home deposit at the crisp age of 21.

Needless to say, I am currently sitting with $157 to my name. (I decided I’d just take the round-ups from each pay…)

WATCH: Simple budgeting with a banana. Post continues below.

But, with 2024 right around the corner, there’s no better time than the present to get started on those *within reach* money goals.

It’s going to take sacrifice, hard work, and perseverance, but I can promise you, as I am promising myself, walking out of the year with $10,000 to your name: Will. Be. Glorious.

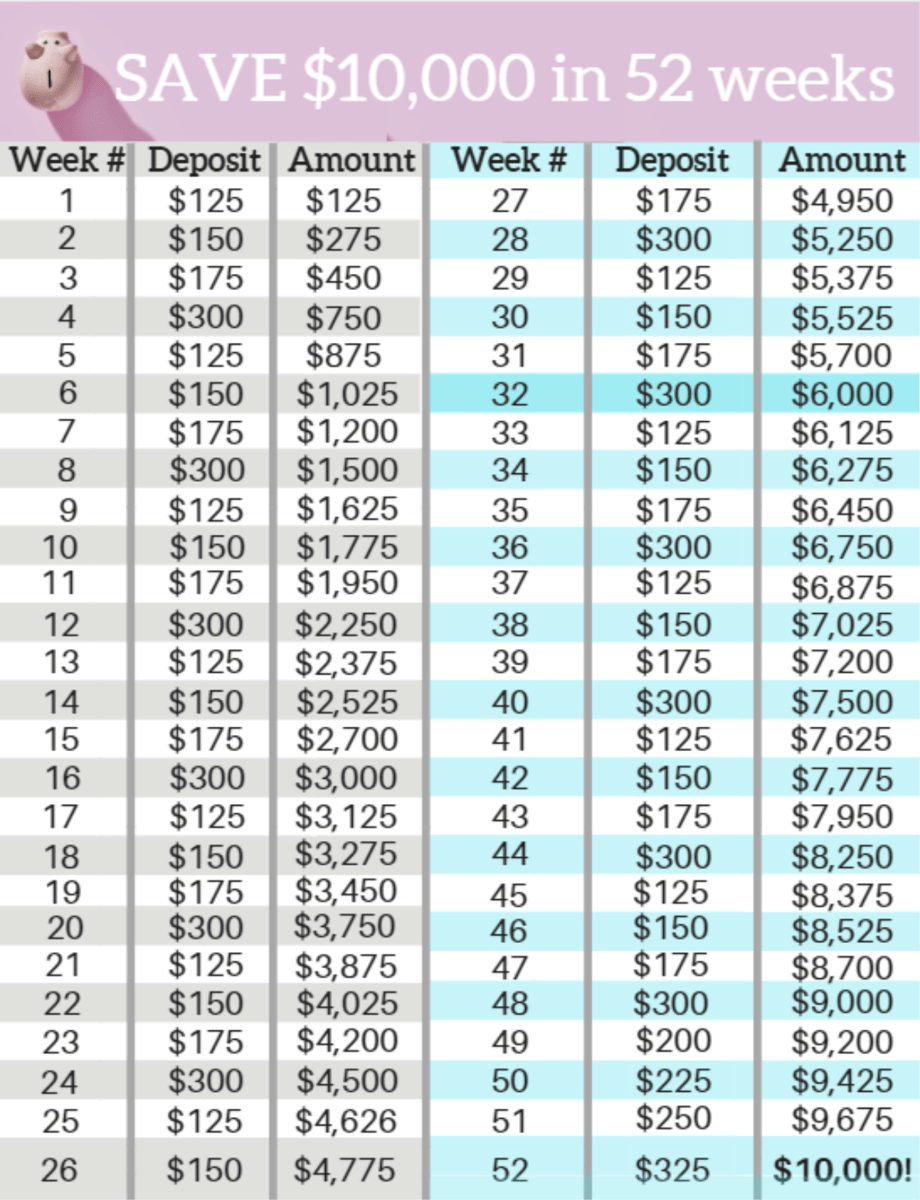

And, thanks to our friends over at Tried and True Mom Jobs there’ll be no hard mathematics involved, as they’ve created a handy, week-by-week plan which will have you entering 2025 $10,000 richer.

Top Comments

Love this article, what about if you get paid once a fortnight, how would one work that out?

To consistently save we need to hack our brain with the latest behavioural science to reduce our reliance on willpower. Four keys strategies include:

- Compartmentalise your accounts into at least the following three savings, commitments and impulses.

- Automate saving toward goals and commitments with automatic transfers every pay.

- Remove temptation rather than resisting it by unsubscribing from marketing newsletters, put a 'no junk mail' sticker on your letterbox and only go to the shops when necessary and always with a list.

- Restrict access. Make it hard to impulsively overspend by compartmentalising your accounts (as above) and only carry a debit card for your impulses account. Cancel credit cards or at least don’t carry them with you.