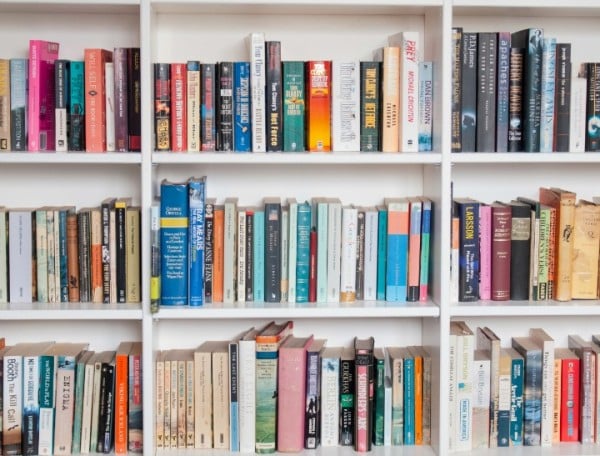

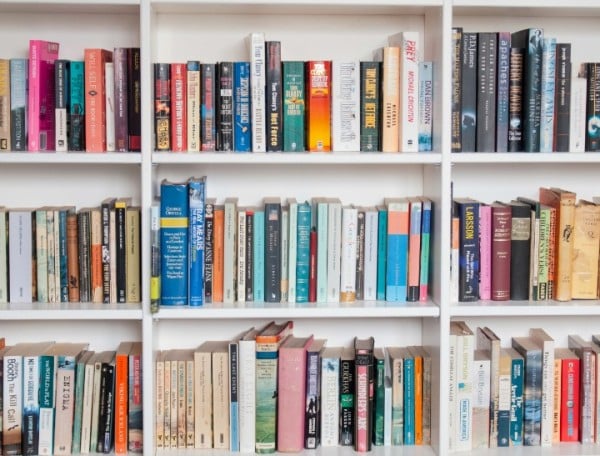

When I can’t sleep, I buy self-help books. My bookshelf is sagging with them. I tend to buy self-help books online, so about a week after a particularly sleepless night, I’ll find my letterbox bulging with some Oprah-endorsed wisdom on whatever was keeping me awake.

But the embarrassing truth is, I read very little of the self-help books I buy. They just pile up on a shelf that I keep in my room so that visitors can’t see just how many trees have died in my pursuit of inner-peace.

The books sit there with my adult dot-to-dot books, and my books on how to write a screenplay, how to screen print a t-shirt, how to generally be better looking and more fun at parties… And they never, ever get read.