We're more than halfway through 2024, and it's safe to say many of us haven't hit our anticipated savings goals.

But what if we told you there's a tangible way to do a 'financial reset' now, to help boost your savings and tackle the cost of living in a practical way? Sounds quite nice.

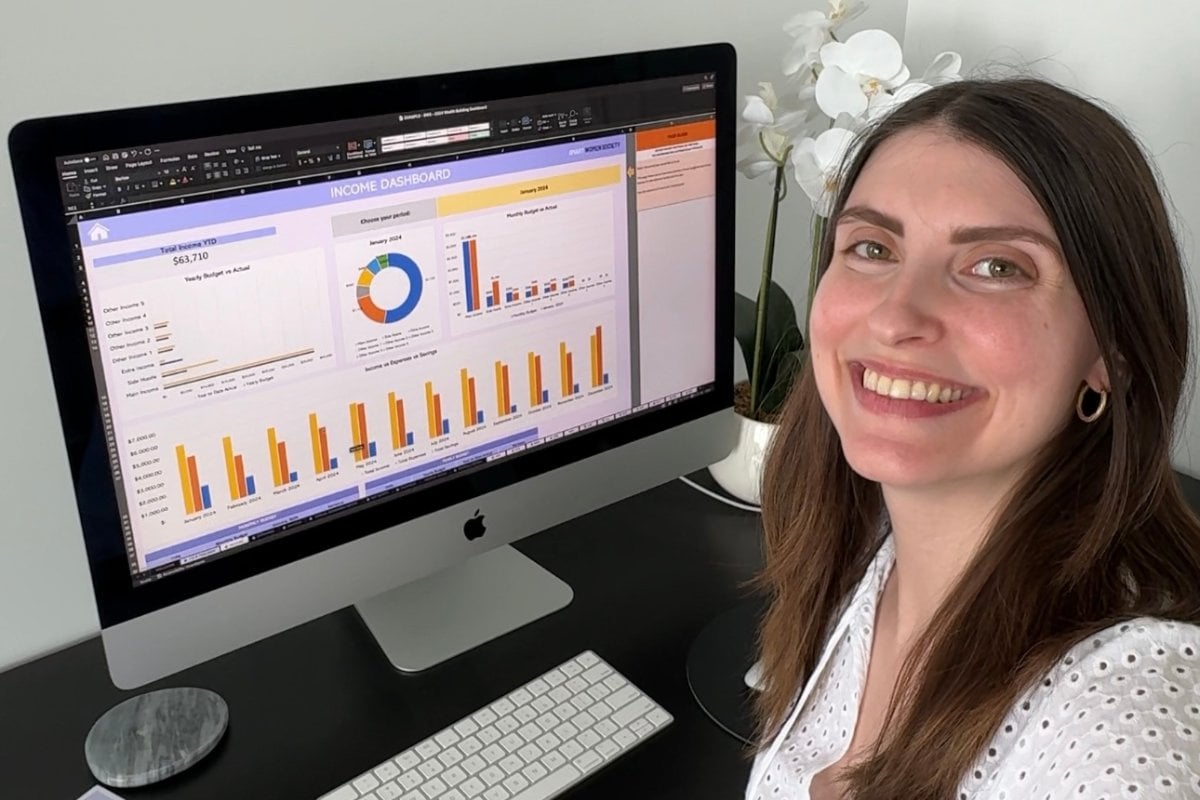

Téa Angelos is a money expert, author and the founder/CEO of Smart Women Society. It's one of the world's largest and fastest-growing online education platforms helping hundreds of thousands of women get smarter with money.

"Women in particular face unique challenges — we live longer than men, we earn less, and we also save and invest less. Money equals freedom," Angelos tells Mamamia. "The biggest decisions in your life should be made by you, not dictated by your bank account. That's what inspires me to help women create financial independence for themselves."

Téa's 5 rules to live by in 2024.

In comes the financial reset.

Origin Energy has partnered with Smart Women Society to create a five-day challenge that people can follow when suits them best. It's all about building up your bank accounts and saving your hard-earned money.

1. Create your budget.

A budget is simply a plan for your money. As the experts say, knowledge is power.

"A well-planned budget helps you understand where all your money is going and it helps you work towards your financial goals. A budget should have balance, it shouldn't be too restrictive."

What Angelos recommends starting with is figuring out how much money you have coming in and out every month.

"These activities are simple for a reason. Understanding your cash flow here is key. To do this, I recommend people print off their last one or two monthly bank statements. Get two different highlighter pens and mark your essential and non-essential spending of the month."