Click here to download and save a PDF version of this article which can be printed or shared with those in your life who may be vulnerable.

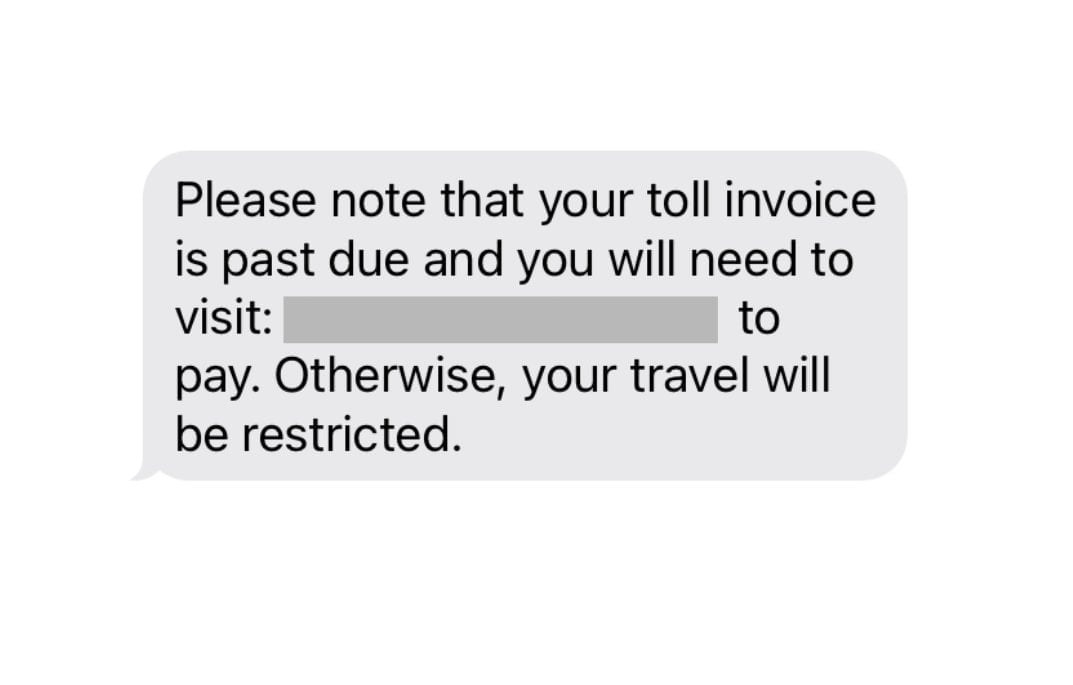

"Please note that your toll invoice is past due."

That was the text message I received from a number last month telling me I'd need to visit a link or "my travel would be restricted".

"Great," I thought as I added it to the end-of-year to-do list in my head, under last-minute Christmas shopping.

It was only until I sat down the next day to deal with it, that I realised the message was quite obviously a scam.

If the questionable link wasn't enough, the fact that there was no information on who sent the message set alarm bells ringing.

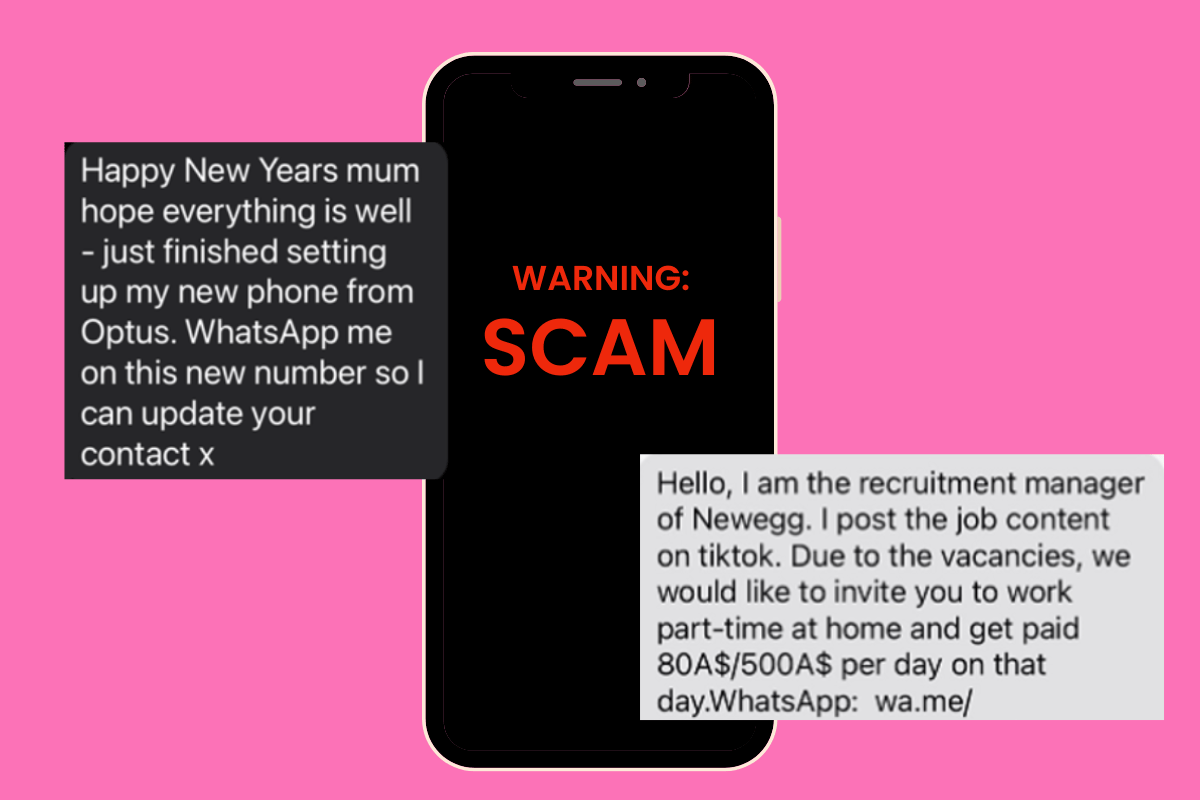

Image: Supplied.

Image: Supplied.

Top Comments