Many of us are guilty of voicing our New Years’ resolutions with little or no intention of actually making them happen.

In theory, we’d all like to have more time with the family, focus on our careers and be more savvy with money, but how are you actually going to make that happen this year?

Inflated costs for childcare, groceries and other household items can make managing your household budget a challenge, which is why it’s important to seek out money-saving opportunities.

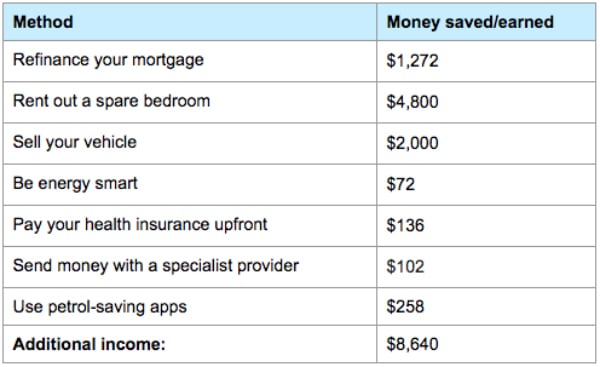

From scoring a better deal on your home loan, to being more conscious of your energy usage, to paying your health insurance premiums upfront, there are a few good money hacks that can help you bring in the savings in 2018.

Refinance your financial products.

Reviewing your home loan every few years is something that every mortgage holder should do. The money you could save from paying less interest can be substantial over the life of a 30-year loan.

For example, if you had a $350,000 home loan and you were paying the average standard variable rate of 5.08 per cent p.a. and you then managed to get a rate discount of 0.5 per cent, you’d save over $1272 per year.

While the prospect of refinancing may be unsettling, it’s a little bit of effort for a large potential financial gain. Strike up the conversation with your bank and ask for a better rate. Chances are that they’ll grant you a rate discount on the spot.