Well, that escalated quickly.

One week I’m all like ‘Sure buy some cheap shares’ and the next I’m like ‘Yeah, so you should probably start learning to grow your own herbs and bake your own bread’.

Things are crazy. Last night I spoke to my retired dad. He said he’s fine, as long as he doesn’t look at the stock market.

Side note… A study found the optimal salary for happiness, and it’s more achievable than you might think. Post continues below.

We talked about tightening our belts and digging out my Grandma’s Country Women’s Association cookbook for some thrifty living recipes. Boiled fruitcake recipe available if anyone’s interested? (Oh wait, you need flour for that, and that’s become a weird luxury item).

His line of the week was: “The time of the tight-arses has arrived”. And damn, he is right. We’re cool all of a sudden.

People have been asking me about various topics and my main answer is: it’s time to hunker down. Sometimes doing nothing is the right choice.

Top Comments

If you don't want to prop up the economy, then don't expect a handou.

Aren't most of us invested in the share market via our super? That could be a good place to start looking.

I don't like purchasing individual shares, but you could look at increasing your exposure to growth (keeping in mind the associated costs of course).

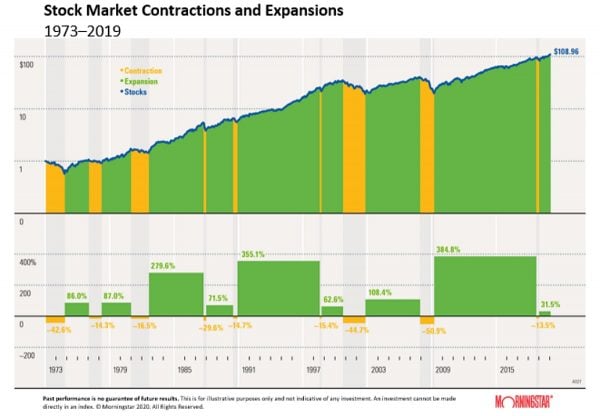

The other thing i would say is be careful if you want to get out of the market right now. If you invested $1,000 in the S&P 500 in 1970, but you missed the one biggest day of returns, your overall returns would be down by $14,000, if you miss the 5 best days that figure goes up to $50,000.