Whether you’re a new mum considering child care or you’re already part of the system, the Turnbull Government’s new child care package next year will overhaul the subsidy scheme to deliver more support for more families.

With each family affected differently, it’s important you understand what it will mean for you depending on your circumstances.

The new Child Care Subsidy – in a nutshell.

You may be all too familiar with the complexity of accessing two different payments under the current system, especially if you have more than one child in care.

Under the new package, the current Child Care Rebate and Child Care Benefit will be replaced by a single Child Care Subsidy. We will subsidise the cost of your child’s care and pay the new subsidy directly to the provider, meaning you only pay the difference.

There are three factors that will determine how much Child Care Subsidy you can receive:

- Your combined family income – how much your family earns will determine the percentage of subsidy you are eligible for.

- Your activity level – this will include a number of activities including work, study and volunteering.

- The type of child care service your family uses – whether it’s centre-based care, family day care or outside school-hours care.

If your family earns $185,710^ or less per year, we’re getting rid of the current $7,613 rebate cap that hurts so many family budgets before the end of each financial year. If your family earns more than this (up to $350,000^), the rebate cap will be lifted to $10,000^ per child, per year.

Breaking down the activity test.

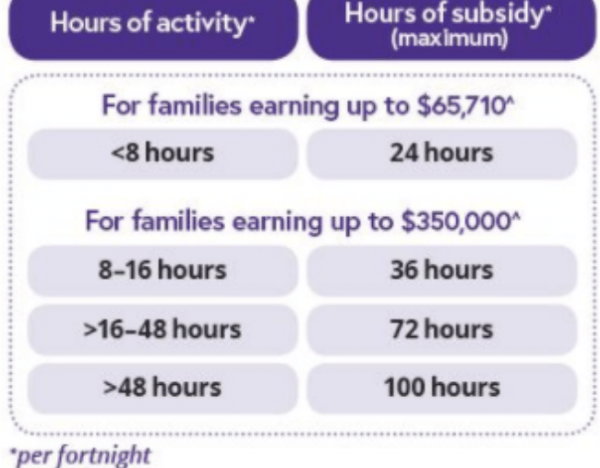

As we have now, there’s an activity test. The number of hours of subsidised child care will be more closely aligned with how much ‘approved activity’ parents undertake per fortnight.

Top Comments

I can't believe that you can earn $350,000 per year, and still pick up $10,000 from the taxpayer per child. Talk about subsidising the wealthy.

The days of welfare being for those who truly need are gone and Australia has morphed into one of those 'cradle to grave' welfare states.

Because you want those people working - they’d pay well over $100K in tax per year. Plus the economic benefits of keeping women in the workforce - paying tax, earning super, maintaining career trajectory, so it’s a small investment for lifelong economic benefit.

If your earning $350k then your paying your fair share of tax, with little or no other benefits.

Perhaps if there weren't so many handouts, then one might not need to pay so much in tax?