Bernie Madoff learnt from a very young age how to motivate people with money.

When people wouldn't play with him as a child, he'd offer them 25 cents, and they'd quickly change their mind.

As he got older, he became determined to make money and become successful. Which he did. But he also became a fraudster.

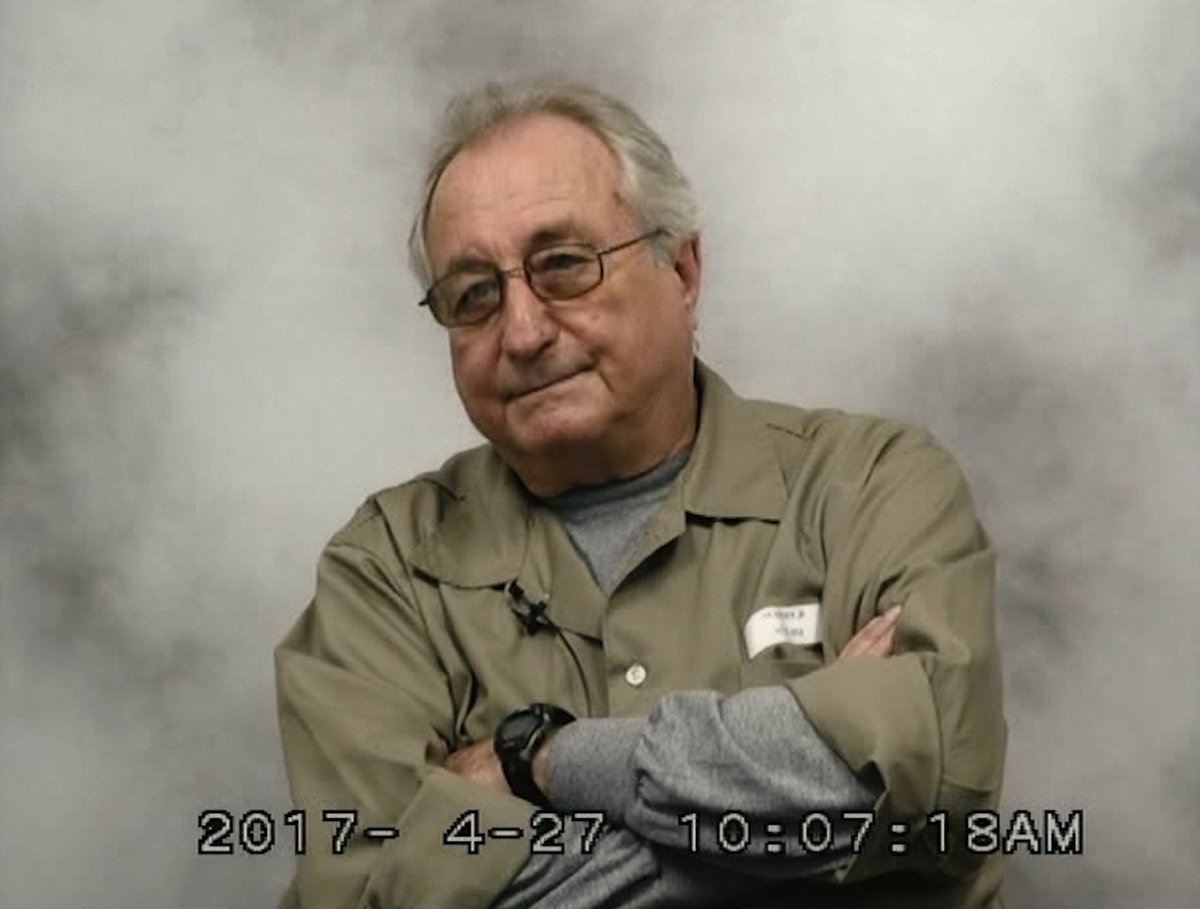

In 2009, at 71, Madoff plead guilty to a series of crimes which gave him the title of the 'mastermind behind the largest Ponzi scheme in history.'

All up he defrauded about $64.8 billion, and his story is being unpacked with fresh eyes in 2023, in a new four-part Netflix documentary called, Madoff: The Monster of Wall Street.

Watch the trailer for Netflix Madoff: The Monster of Wall Street. Post continues below.

This is his story.

Climbing the ranks: 'Happy to take the crumbs.'

Madoff was part of a tide of young hopeful money makers who flooded the market in the early 60s.

America was bouncing back from World War II and The Great Depression and there was a strong appetite to make money and build the country back up.